Table of Content

In either case, it’s always smart to set aside some readily accessible funds in the case of an emergency, or even to replace your roof or handle some other household repairs. And if you invest money early on instead of paying down your mortgage, your gains can be exponentially better. There are so many variables that you really need to whip out an early payoff calculator, talk to your CPA, visit a financial planner and/or retirement specialist, and so on and so forth. Still, with mortgage rates as low as they are, you don’t need to be Warren Buffett to win the game.

You would have considerably fewer savings via Dave Ramsey's method than if instead, you followed Ric Edelman. The money within your home will be very hard to tap, and you could wind up foreclosing on your home anyway. This is the exact issue Dave Ramsey is suggesting you avoid by eliminating your debt. This proves my point of cash flow is more important than net worth.

FHA Refi and Purchase Loans

If you are paying something monthly, you don’t have the lump sum being with. My desire is to build my various investments to the point where I will earn enough to replace my income and lower my tax rate cause we all know investments are taxed at lower rates. But if you push away the fear you will see the lender is giving you money at 3% after deductions that historically returns 7% in the market. But, you took on risk when you bought the property in the first place. Way too many folks on here with comments like I feel like or I’m scared to.

Something I would never been able to do if I was sending the bank all of my money to pay off my mortgage on a property that earns me no income. I recently completed a somewhat simple mortgage model for a class and one of the things I did was to evaluate mortgages based on the personal rate of return for residual income . When you assume a 0% rate then a lot of the common wisdom obviously stands. However when assume that your savings can earn a return on their own (say at 8%) the situation shifts dramatically.

Should I pay off my mortgage early?

Home Loans can offer great tax benefits with attractive rebates on the principal and interest components. That’s a good enough reason for you to never overlook the tax benefits of the loan. Prepaying a Home Loan might not be the best alternative in every case. By paying the principal loan sooner you’re increasing the equity you have on your home, and will be able to own it earlier than expected. I pushed myself to pay double EMI for the initial few years as my interest rate at that time was 9.8%. So every month, the interest payment for the month goes down while principal repayment goes up.

She would have a $100,000 in capital gains and would be under the $250k limit you mentioned. Capital gains taxes are extremely low at 15% for the long-term outside of retirement accounts. So the savings should most definitely go into tax deferred accounts first.

Should you worry about a mortgage prepayment penalty?

However, it’s also important to think about the drawbacks. Let’s say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year.

Instead, try to instill some waves of gratitude towards a) the bank who gave the loan, b) towards the government who gave the benefits of 80c and 80 EE. The most recognized 3.5% down payment mortgage in the country. Dev is a SEBI-Registered Investment Advisor . He works with small investors as well as HNI clients across India. I dont know, if this post is old or new, but i would like to add my views.

You are getting more than , by way of rent payment ,you are putting only 4000 into RD. This is a gesture of thanks and also to help the demand supply mismatch, as explained earlier. Now the assessment of values as at the end of 120 months.

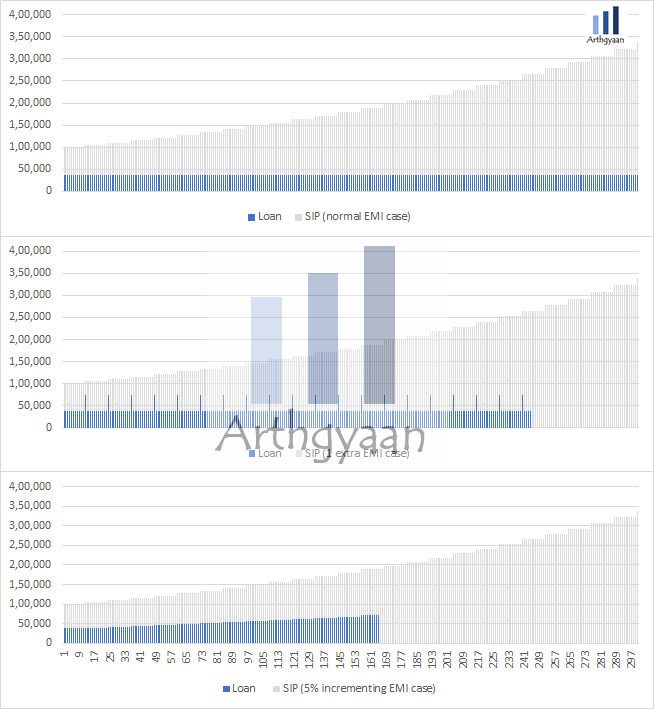

So you can either shorten the loan tenure and keep the EMI constant OR reduce the EMI and keep the loan tenure constant. Lenders generally keep the EMI constant and reduce the home loan tenure. Some lenders might go for the opposite and reduce the EMI and keep the tenure constant. Now let’s see how 2 things are impacted depending on when you make the prepayment. First, how the total interest paid during the 25-year tenure is impacted; and Second, how many EMIs you save and how early is the loan closed. As soon as they take a home loan, most people start thinking about how to prepay home loan quickly and close it as soon as possible.

Either way, the big banks get to play around with your money. They make huge profits and let a few coins slip through to us. The convicted criminal banks destroy everything of value and they do not care about you or me. The builder of your house gets paid less than the banks. No one knows what the market will do in the LT. Assuming the historical average return is nothing more than saying past performance will dictate future performance. The author is a fool and simply cannot do math or else is a freeloader and doesn’t think anyone pays taxes.

Moreover, banks and NBFCs do not charge you a prepayment penalty on the prepayment of floating rate home loans. Buying a house is not only ones biggest dream in our lifetime but is also undoubtedly the significant financial task of our lifetimes. One of the most innovative ways to save money is to prepay your home loan early. You may prepay the entire outstanding home loan amount or prepay partially to save on home loan interest payments. Prepaying a home loan is the best thing that a borrower can do.

Roth IRA’s are protected , but I bet people will be paying 20-30% taxes on 401k and other investments in the future. “If you have a large quantum of a home loan or the bank is charging you a higher home loan rate, then it may be a good idea to prepay your home loan. However, you may continue with the home loan if the bank charges you a lower home loan rate and you avail of significant tax benefits on home loan principal and interest," said Archit Gupta. You can use the fund for creating better and bigger contingency corpus. Apart from Home Loan, if you take any other loan from the banks or financial institutions, then the rate of interest would not be less than 9% or 10% p.a. In an emergency, if you apply for a Personal Loan, then it may cost you 12% to 24% p.a.

For most prepayment methods to give you significant results, have the discipline to make them on as regular a basis as you can. Make your choice whether to prepay or not, after considering all the scenarios and do not forget to consult your financial advisor before you make up your mind. Home Loan plays a key role in possessing your own property. Although, Home Loan helps you in creating an asset, you should spare time afterwards to plan and clear this debt at the earliest. This will enable you to create wealth and also allocate resources for more asset creation.

Mortgage prepayment philosophy

Choose a location according to your budget and try your best to get the right deal. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. On the other hand, equities could deliver higher returns but are uncertain at least in the short term.

No comments:

Post a Comment